Why TaP?

Fraud Risk : Understanding the Risk

Fraud risk and credit risk are two distinct yet interconnected concepts in the realm of financial services. While both terms relate to potential losses for institutions, they address different aspects of risk assessment. Credit risk is usually a matter of the clients affordability, while fraud risk speaks to whether the business will recover the funds or not.

Fraud Risk: Fraud risk pertains to the potential of individuals or entities engaging in deceptive activities to deceive and exploit financial institutions. It involves deliberate acts of misrepresentation, identity theft, or illicit transactions that can lead to financial losses, reputational damage, and regulatory non-compliance. Detecting and preventing fraud is crucial for maintaining the integrity of financial systems and protecting both institutions and their customers.

WHY TO CHOOSE TaP

Transact with confidence Know your customer better

#1

TaP provides a wealth of information on the clients collected from various institutions, Know your customers better

#2

TaP provides realtime eligibility calculations helping institutions to make informed decisions

#3

TaP protects your funds from all known fraudsters Give a service with confidence

KEY FEATURES

100% Secure all client data is encrypted and securely stored

We use military grade technology to encrypt and store clients data.

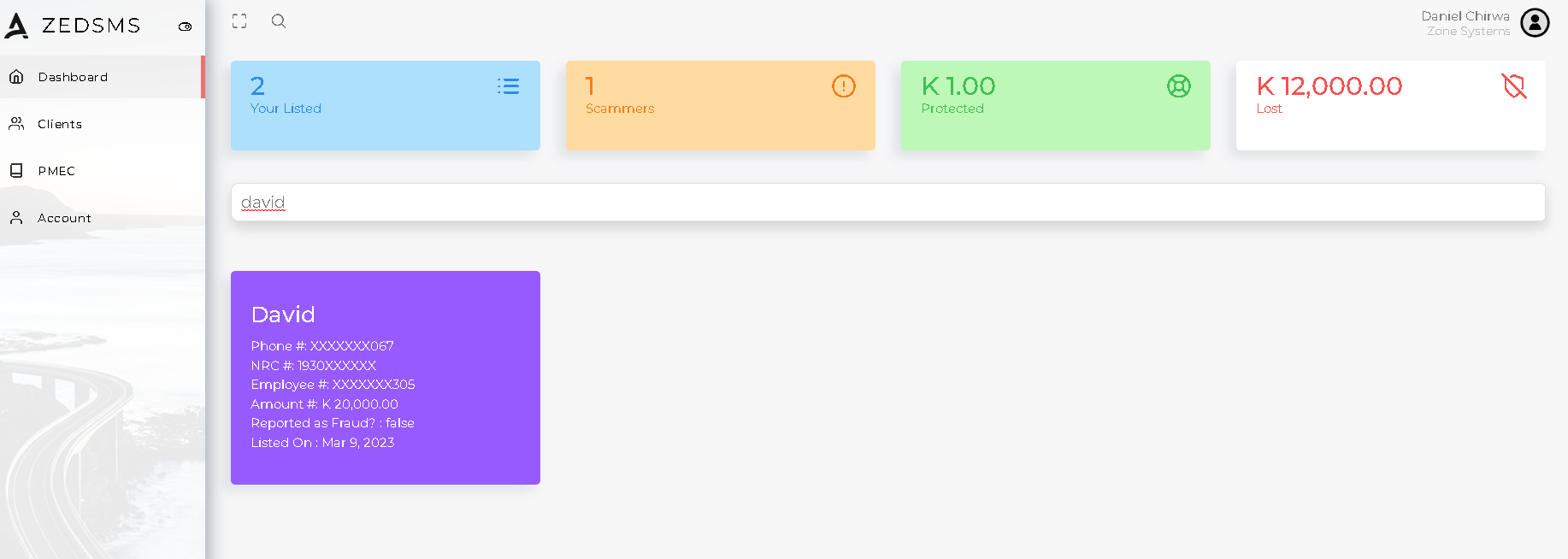

Admin Dashboard TaP has an easy to use dashboard

With easy to use navigation and friendly interface, TaP can be taught in 10 minutes

24/7 Availability TaP never goes down

TaP is accessible from anywhere in the world at any time

TaP NOW

Start now and

protect your funds with TaP

100+

Known Fraudsters

10+

Data Partners

200000k+

Customers

3+

Years in Fraud Prevention

TaP is purely made in Zambia, it is an anti-fraud platform to protect institutions and organization against known fraudsters, TaP enables these institutions to make an informed fraud decisions based on the applicants fraud history